Loading

Get Nj Dot Nj-1040x 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ DoT NJ-1040x online

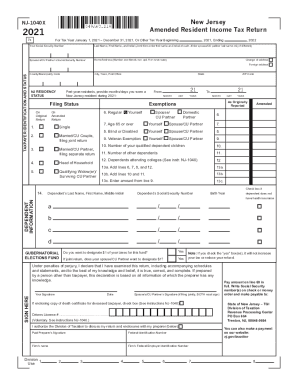

The NJ DoT NJ-1040x is the Amended Resident Income Tax Return for New Jersey, allowing users to correct inaccuracies in their previously submitted tax return. This guide offers step-by-step instructions for completing this essential form online, ensuring an accurate and streamlined filing process.

Follow the steps to complete your amended tax return online.

- Click ‘Get Form’ button to access the NJ-1040x form and open it for editing.

- Fill in your Social Security number and last name, first name, and initial. If filing jointly, include your partner's details only if different.

- Provide your home address, including apartment number or rural route, and indicate if there is a change of address.

- Indicate your taxpayer identification and status, including county/municipality codes and residency status during the tax year.

- Choose your filing status from the provided options: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Complete the exemption section, indicating the number of dependents and their corresponding details.

- Enter your income information in the specified lines, including wages, interest, dividends, and other incomes.

- Deduct any applicable pension or retirement exclusions from your total income to calculate your New Jersey gross income.

- Calculate the total exemptions and deductions that apply to your circumstance and subtract these from your gross income to determine your taxable income.

- Complete the tax calculation and any credits you may qualify for based on your situation, ensuring accuracy with any deductions or credits mentioned.

- Review the total tax due or any overpayment amounts, and provide any necessary payment information.

- Sign and date the form where indicated. If filing jointly, ensure both partners provide their signatures.

- Once completed, save your changes, download the form for your records, and print or share it as necessary.

Complete your NJ DoT NJ-1040x online today to ensure your amended tax return is processed efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Who Must File your filing status is:and your gross income from everywhere for the entire year was more than the filing threshold:Single Married/CU partner, filing separate return$10,000Married/CU couple, filing joint return Head of household Qualifying widow(er)/surviving CU partner$20,000 Dec 15, 2022

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.