Loading

Get Sc Dor Sc1041 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1041 online

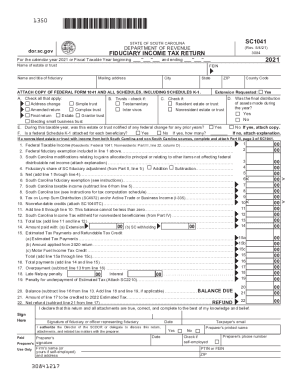

Filling out the SC DoR SC1041 form online can seem daunting, but this guide will simplify the process for you. With clear instructions for each section, you will be able to complete the fiduciary income tax return efficiently and accurately.

Follow the steps to successfully fill out the SC1041 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the estate or trust, along with the name and title of the fiduciary in the designated fields.

- Provide the Federal Employer Identification Number (FEIN) and the mailing address for the estate or trust.

- Check the appropriate boxes regarding the type of fiduciary return, which may indicate if the return is amended, final, or if an extension is requested.

- Complete the federal taxable income section by inputting the figures from the federal 1041 form (residents) or the specified line for nonresidents.

- Fill in the various modifications relating to gains allocated to principal or other items not affecting the federal distributable net income.

- If applicable, fill out Part II to allocate the South Carolina fiduciary adjustment among the beneficiaries.

- For nonresident estates or trusts, complete Part III to compute the federal taxable income from South Carolina sources.

- Utilize Part IV to indicate the nonresident beneficiaries' shares of income and ensure tax is withheld correctly.

- Review all entries for accuracy, and sign the form. Finally, you can save changes, download, print, or share the completed SC DoR SC1041 online.

Start filling out your SC DoR SC1041 online today to ensure timely and accurate submission.

Related links form

While fiduciary income tax is the income taxation of a person's estate or trust assets, estate tax is a tax on the right to transfer property when a person passes away.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.