Loading

Get Wa D-2441 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WA D-2441 online

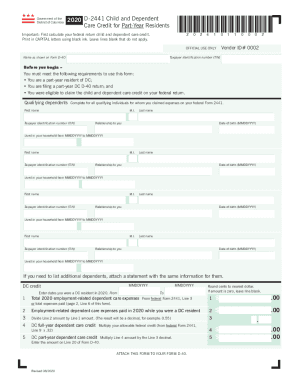

This guide provides step-by-step instructions on how to complete the WA D-2441 form online. It is designed to assist users of all experience levels in accurately reporting their child and dependent care credit.

Follow the steps to successfully complete the WA D-2441 form online.

- Press the ‘Get Form’ button to access the WA D-2441 form and open it for completion.

- Begin by inputting your name as it appears on Form D-40 in the designated field. Ensure all information is accurate.

- Enter your taxpayer identification number (TIN) in the corresponding box. This is crucial for tracking your tax record.

- Indicate the dates you were a resident of DC in 2020. Provide the starting and ending dates in the format MMDDYYYY.

- List all qualifying dependents for whom you have claimed child and dependent care expenses. Fill in each dependent's first name, middle initial, last name, relationship to you, date of birth, and the specific dates they lived in your household.

- If you need space for more dependents, include a separate statement with the same required information.

- In the ‘DC credit’ section, input your total 2020 employment-related dependent care expenses from federal Form 2441.

- Calculate the applicable amount by dividing Line 2 by Line 1. This result will be the decimal you need for further calculations.

- Determine your DC full-year dependent care credit by multiplying your allowable federal credit by 0.32.

- Finally, calculate the DC part-year dependent care credit by multiplying the amount from Line 4 by the decimal from Line 3. Ensure to enter this value on Line 20 of Form D-40.

- Review all input for accuracy. Save your changes, and if necessary, download, print, or share the completed form.

Complete your forms online now for a smoother filing experience.

Related links form

Those rates—ranging from 10% to 37%—will remain the same in 2023. What's changing is the amount of income that gets taxed at each rate. For example, in 2023, an unmarried filer with taxable income of $95,000 will have a top rate of 22%, down from 24% in 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.