Loading

Get Irs 2106_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2106_DSA online

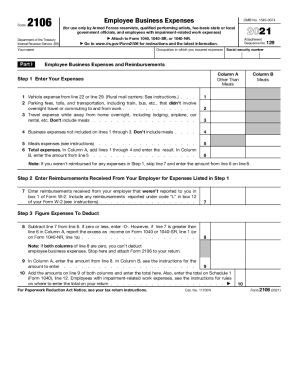

Filling out the IRS 2106_DSA form is essential for individuals seeking to claim employee business expenses. This guide will provide you with detailed, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the IRS 2106_DSA form.

- Press the ‘Get Form’ button to access the IRS 2106_DSA form in your browser.

- Begin with entering your name and occupation in the appropriate fields as referenced in Part I. Make sure to include your social security number.

- In Part I, list your employee business expenses. Input the vehicle expense in line 1, parking fees and tolls in line 2, and overnight travel expenses in line 3. Do not forget to include any other business expenses in line 4.

- Next, add the total expenses for Column A from lines 1 through 4, and report meal expenses in Column B on line 5. Then, calculate the total on line 6.

- Proceed to Step 2, where you will input any reimbursements received from your employer that were not reported on your W-2 form. Enter this amount on line 7.

- In Step 3, calculate your deductible expenses by subtracting line 7 from line 6 and entering the result on line 8. Ensure that if the figure is zero or less, you enter -0-.

- For both Column A and Column B, proceed to enter the amounts in line 9 and sum both column totals on line 10.

- Move to Part II if you are claiming vehicle expenses. Complete the General Information section by providing details such as the date the vehicle was put into service and total miles driven for the year.

- Select the appropriate section for vehicle expenses based on your situation — either Section B for Standard Mileage Rate or Section C for Actual Expenses.

- After completing all relevant sections, review your entries for accuracy. Once satisfied, save your changes, download the completed form, or print and share it as needed.

Get started with filling out your IRS 2106_DSA form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

If you qualify, complete Form 2106-EZ and include the part of the line 6 amount attributable to the expenses for travel more than 100 miles away from home in connection with your performance of services as a member of the reserves on Form 1040, line 24, and attach Form 2106-EZ to your return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.