Loading

Get Mt Dor Est-i 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT DoR EST-I online

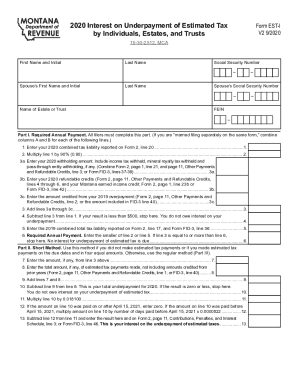

Filling out the MT DoR EST-I online can seem daunting, but this guide aims to streamline the process for you. This form is essential for determining if you owe interest on the underpayment of estimated tax, providing clarity on your tax obligations for the year.

Follow the steps to complete the MT DoR EST-I with ease.

- Click ‘Get Form’ button to access the MT DoR EST-I form and open it in your preferred online editor.

- Begin by entering your first name, initial, and last name in the designated fields at the top of the form.

- Input your Social Security Number, followed by your spouse's information if applicable, including their first name, initial, last name, and Social Security Number.

- If you are filing for an estate or trust, provide the name and FEIN in the appropriate sections.

- Proceed to Part I, which is required for all filers. Enter the total of your 2020 combined tax liability reported on Form 2, line 20.

- Calculate 90% of your total tax liability by multiplying the figure from the previous step by 0.90.

- Fill out the withholding details in lines 3a, 3b, and 3c. Ensure you accurately combine amounts as required.

- Add the total withholding and credits on line 3 and subtract from your total liability to determine if you owe any interest.

- Continue to Part II or III based on your estimated tax payments. Complete the calculations as guided for the method applicable to you.

- Finally, review all entries for accuracy. When completed, you have the option to save changes, download, print, or share the MT DoR EST-I form as needed.

Complete your MT DoR EST-I online now to ensure your tax obligations are met efficiently.

Related links form

Business Tax Return Information For refund information on federal tax returns other than Form 1040, U.S. Individual Income Tax Return, call, toll free, at 800-829-4933. From outside the U.S., call 267-941-1000. TTY/TDD: 800-829-4059.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.