Loading

Get Mn Rev184i 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN REV184i online

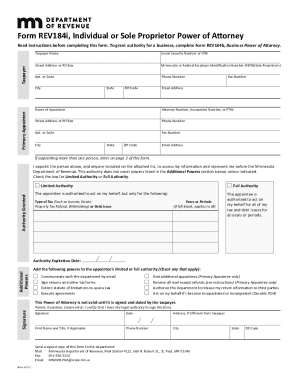

The MN REV184i form is a Power of Attorney used by individuals or sole proprietors to authorize another person to act on their behalf before the Minnesota Department of Revenue. This guide provides clear, step-by-step instructions on how to complete the form accurately online.

Follow the steps to complete the MN REV184i form.

- Press the ‘Get Form’ button to download the form and open it in the online editor.

- Enter the taxpayer's name and contact information including phone number and email address. This information must be accurate to ensure proper processing by the Department of Revenue.

- Provide the taxpayer identification numbers: Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Federal Employer Identification Number (FEIN) for sole proprietors. It is crucial to include these to validate the authority.

- List the primary appointee's details, including their name, phone number, email, and professional identification number (e.g., Attorney Number or PTIN). This ensures that you have chosen a qualified representative.

- Choose whether to grant the appointee Limited Authority or Full Authority. Limited Authority restricts them to specific tax issues, while Full Authority allows broader access to all tax matters.

- If applicable, select additional powers for the appointee, such as the ability to communicate by email or sign tax forms. Be mindful of the implications of these additional powers.

- Sign the form, print your name, and date it. Only sign if you have the legal authority to do so, as this is essential for the validity of the form.

- Submit the completed form to the Minnesota Department of Revenue either by mail, fax, or email based on your preference for communication.

Complete your MN REV184i form online today to empower your appointees efficiently.

A power of attorney (POA) is a legal document that grants an attorney, accountant, agent, tax return preparer, or other person authority to access the business taxpayer's account information and represent the taxpayer before the Minnesota Department of Revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.