Loading

Get Resident Qualifying Criteria

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Resident Qualifying Criteria online

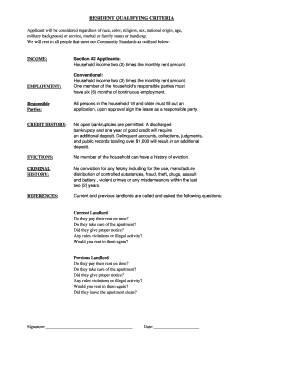

Filling out the Resident Qualifying Criteria online is an essential step in ensuring your eligibility for housing. This guide provides clear instructions to help you navigate through the form with ease.

Follow the steps to complete your Resident Qualifying Criteria form online.

- Press the ‘Get Form’ button to access the Resident Qualifying Criteria form and display it on your device.

- Begin by entering the date of application at the top of the form. This ensures that your submission is time-stamped accurately.

- Fill in the property name and specify the number of bedrooms you are requesting. Additionally, include your desired move-in date.

- Under household information, provide the names, relationships, and contact information for all household members who will live in the unit.

- Complete the income section by listing all sources of income for each household member, including employment, benefits, and any other relevant information.

- Next, disclose any property or housing references by listing your current and previous landlords with their contact details.

- Address the questions regarding potential household changes, custody of children, and any prior evictions or criminal history. Answer these questions clearly and honestly.

- Finally, review all provided information for accuracy. Ensure that all adult household members sign and date the form where indicated. After reviewing, you can save changes, download the completed form, print it, or share it as necessary.

Complete your forms online today to secure your housing eligibility!

Related links form

For tax purposes, a residence is any place you occupy regularly and where you have a fixed, ongoing connection. This includes temporary and permanent homes. By applying the Resident Qualifying Criteria, you can determine how your residence influences your tax status and what deductions you might qualify for.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.