Loading

Get Ct 247 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 247 online

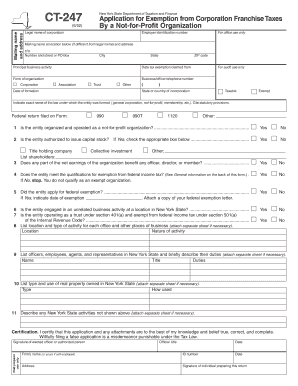

Filling out the Ct 247 form is a vital step for not-for-profit organizations seeking exemption from New York State corporation franchise taxes. This guide provides you with detailed, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Ct 247 form effortlessly.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- In the ‘Mailing name and address’ section, enter the legal name of your organization. If the mailing address differs from the legal name, provide that information in the designated field.

- Fill out the employer identification number in the provided field. This unique number identifies your not-for-profit organization.

- Indicate the principal business activity of your organization. This helps classify the organization's purpose.

- Specify the date from which you are claiming the tax exemption, along with the date of formation of the organization.

- Select the form of organization by checking the appropriate box for 'Corporation,' 'Association,' 'Trust,' or 'Other.' Provide the state or country of incorporation.

- Answer the questions regarding the organization's structure and operations by selecting 'Yes' or 'No' in the respective fields. This includes questions on not-for-profit status and any potential benefits to officers or members.

- If applicable, indicate if the entity has applied for federal exemption and provide the date of that application. Be sure to attach the federal exemption letter, if available.

- List details about any unrelated business activities conducted in New York State as well as locations and types of activities for each office.

- Complete additional sections listing officers, employees, and any identifiable properties owned in New York State, attaching any necessary separate sheets for additional information.

- Ensure you read and sign the certification statement, confirming that the information has been completed to the best of your knowledge.

- If you used a preparer, they must provide their information and signature in the designated fields.

- Once all sections are complete, save your changes. You may also download, print, or share the completed form according to your needs.

Complete your Ct 247 application online today to secure your not-for-profit organization’s tax exemption.

To file form 10IEA, begin by ensuring you have all relevant information at hand. Complete the form with your financial details and double-check for accuracy. Utilizing platforms such as uslegalforms can streamline the process and ensure that your submission aligns with CT 247 standards.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.