Loading

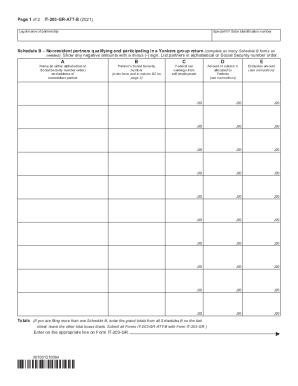

Get Form It-203-gr-att-b Schedule B - Yonkers Group Return For Nonresident Partners Tax Year 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-203-GR-ATT-B Schedule B - Yonkers Group Return For Nonresident Partners Tax Year 2021 online

Filling out the Form IT-203-GR-ATT-B Schedule B is essential for nonresident partners participating in a Yonkers group return. This guide provides clear, step-by-step instructions to assist you in completing the form efficiently and accurately.

Follow the steps to complete the form accurately and submit it online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the legal name of the partnership at the top of the form to ensure proper identification.

- Provide the special New York State identification number, which is crucial for state record-keeping.

- For Schedule B, list all nonresident partners in alphabetical order or by Social Security number, ensuring that their names are correctly spelled.

- Input the partner’s Social Security number in column B and ensure it matches the number entered in column B2 of page 2.

- Record the federal net earnings from self-employment for each partner in column C.

- Allocate the earnings to Yonkers by entering the appropriate amount in column D according to the guidelines provided.

- Include any exclusions in column E as per the instructions to accurately reflect the taxable earnings.

- If multiple Schedule B forms are completed, add all totals on the last sheet and leave other total boxes blank.

- Proceed to page 2 and capture the partner’s Social Security number in column B2, then calculate Yonkers taxable earnings in column F by subtracting column E from column D.

- In column G, compute the Yonkers nonresident earnings tax by multiplying the amount in column F by 0.005.

- Document any Yonkers estimated income tax paid in column H, utilizing the amount paid with Form IT-370.

- Determine the balance due in column I by subtracting column H from column G.

- Calculate any overpayment in column J by subtracting column G from column H.

- For additional group returns, refer to the appropriate line and complete any required information.

- Once the form is complete, save changes, download the document, and prepare it for submission.

Complete your Form IT-203-GR-ATT-B online to ensure accurate filing and compliance.

New York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.