Loading

Get Roth Ira Trust Application Packet (form 2400r-t)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ROTH IRA TRUST APPLICATION PACKET (FORM 2400R-T) online

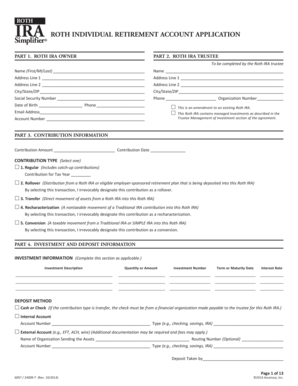

Completing the Roth IRA Trust Application Packet (Form 2400R-T) is an essential step in establishing your Roth Individual Retirement Account. This guide provides clear and supportive, step-by-step instructions to assist you in filling out the form online, ensuring that you meet all requirements and facilitate a smooth application process.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to obtain the Roth IRA Trust Application Packet. This will allow you to open the form in a digital editor where you can easily enter information online.

- In Part 1, fill in the Roth IRA Owner section. Begin by providing your first name, middle initial, and last name. Include your complete residential address, city, state, and ZIP code. Enter your social security number, date of birth, and phone number. If applicable, ensure to check the box indicating if this is an amendment to an existing Roth IRA.

- Move to Part 2, Trustee Information. Complete with the Roth IRA trustee's name and address details. Specify their organization number, and provide a contact email address. You may also need to list the account number associated with the Roth IRA.

- In Part 3, Contribution Information, state the contribution amount you intend to make and the type of contribution you are selecting. Options include Regular, Rollover, Transfer, Recharacterization, and Conversion. Make sure to indicate the tax year for the contribution if applicable.

- Advance to Part 4, Investment and Deposit Information. Fill in the investment description, quantity or amount, investment number, term or maturity date, and interest rate for each investment. Additionally, specify the deposit method, detailing cash or check, internal account details, or external account information for asset transfers.

- Proceed to Part 5 for Beneficiary Designation. Clearly list your primary and contingent beneficiaries by providing their names, addresses, dates of birth, tax identification numbers, and the percentage designated for each beneficiary. Ensure that the total percentage equals 100%.

- If applicable, fill in Part 6 for Spousal Consent, affirming understanding of the implications of beneficiary designations if married.

- Finalize your application in Part 7 by signing and dating the document where indicated. If necessary, have your spouse and a witness sign as well, ensuring that all parties are in agreement with the terms set forth in the application.

- Once the form is complete, review all entries for accuracy. You can save your changes, download a copy of the application, or print it for your records.

Start filling out your Roth IRA Trust Application Packet online today to secure your financial future.

Designated Roth 401(k) Contributions and IRS Form 8606.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.