Loading

Get Mortgage Application Checklist Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Application Checklist Pdf online

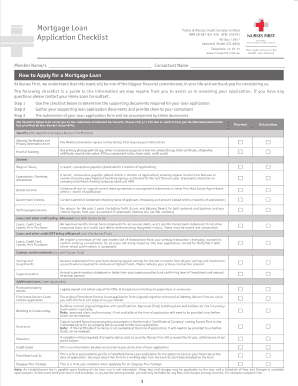

Filling out the Mortgage Application Checklist Pdf is a crucial step in the mortgage application process. This guide provides clear, step-by-step instructions to help users navigate and complete the form reliably and efficiently.

Follow the steps to effectively complete your checklist online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the personal information section. Enter your full name, current address, and contact details accurately to ensure all communication is streamlined.

- Proceed to the employment section. Provide your job title, employer's name, and the length of your employment. If applicable, include your partner’s employment details as well.

- In the income section, document your gross monthly income and any other income sources such as bonuses or alimony. Be thorough to avoid any delays in processing your application.

- Complete the asset section. List all assets, including savings accounts, investments, and property. Ensure you have supporting documentation ready, as it may be required.

- Review the liabilities section and provide information on any debts, including credit card balances, student loans, or auto loans. Accurate reporting is essential for the assessment of your loan eligibility.

- Finish by checking the acknowledgment box and signing the document electronically. This confirms that all information provided is true and accurate.

- Once you have completed all fields, review the information for accuracy. Make any necessary corrections.

- Finally, save the changes, download, print, or share the completed form as required.

Start completing your documents online today for a smoother mortgage application process.

Accurate knowledge of the annual or monthly income of all parties on the application. Step 1: Get a Verified Preapproval Letter. In an increasingly competitive housing market, it is important to make your offer stand out. ... Step 2: Locking in Your Interest Rate. ... Step 3: Loan Processing. ... Step 4: Closing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.