Loading

Get Form 2-ndfl 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2-NDFL online

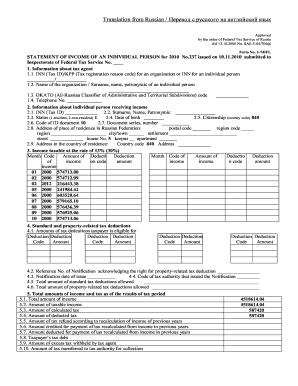

Filling out the Form 2-NDFL online is a crucial step in reporting income for individuals and tax agents. This guide provides clear, step-by-step instructions to help users navigate the form's components effectively.

Follow the steps to complete the Form 2-NDFL online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the information about the tax agent. Enter the INN (Tax ID) and KPP (if applicable) or the individual’s INN. Fill in the name of the organization or the surname, name, and patronymic of the individual. Include the OKATO code and provide a telephone number.

- Next, input the information about the individual receiving income. This includes their INN, surname, name, patronymic, status (resident or non-resident), date of birth, citizenship code, ID document code, document series and number, and addresses both in Russia and the country of residence.

- Document the taxable income received at the rate of 13% or 30%. For each month, include the month code, amount of income, and the corresponding deduction amount.

- Detail the standard and property-related tax deductions. Fill in the amounts the taxpayer is eligible for, along with any relevant deduction codes and notification details related to property-related tax deductions.

- Summarize the total amounts of income and tax for the tax period. Include total income, taxable income, calculated tax, deducted tax, any tax refunds from previous years, and tax debt information.

- After completing all sections, ensure to review all entered data for accuracy. Once finished, save changes, download, print, or share the form as needed.

Complete your Form 2-NDFL online today to ensure timely and accurate reporting.

Related links form

To obtain the PF claim form, visit the EPFO's official site or check with your employer's human resources department. They typically provide guidance on filling out the form properly. Utilizing services like US Legal Forms may offer templates to help streamline your submission of Form 2-NDFL.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.