Loading

Get File A California Llc Articles Of Organization Form - Pick An Entity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the File A California LLC Articles Of Organization Form - Pick An Entity online

This guide provides detailed, step-by-step instructions on how to efficiently complete the File A California LLC Articles Of Organization Form online. By following this guide, users can ensure that they effectively navigate the form and meet all necessary requirements for establishing a limited liability company in California.

Follow the steps to successfully complete the form online:

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

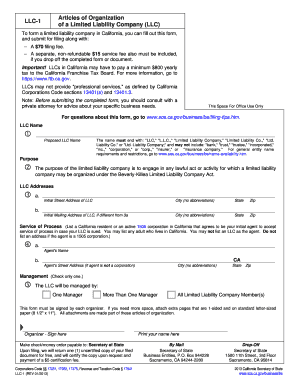

- Provide the proposed name of your LLC in the designated field. Ensure that the name ends with 'LLC', 'L.L.C.', 'Limited Liability Company', 'Limited Liability Co.', 'Ltd. Liability Co.', or 'Ltd. Liability Company'. Confirm that your chosen name does not include restricted terms such as 'bank', 'corporation', or 'insurance company'.

- Specify the purpose of your LLC. You can state that it will engage in any lawful act or activity permitted under the Beverly-Killea Limited Liability Company Act.

- Enter the initial street address of the LLC. Include the complete address without any abbreviations, along with the city, state, and zip code.

- If applicable, provide a different mailing address for the LLC. Again, include the complete address, city, state, and zip code.

- Identify your agent for service of process. This can be a California resident or an active corporation. Include the agent's name and street address, noting that do not list an address if the agent is a corporation.

- Indicate how the LLC will be managed. Select one option: 'One Manager', 'More Than One Manager', or 'All Limited Liability Company Member(s)'. Make sure to check only one box.

- Have each organizer sign the form. If additional space is needed, attach extra pages that are one-sided and in standard letter-sized format.

- Review all entries for accuracy and completeness before submitting the form. Save your changes, then download, print, or share your completed form as needed.

Begin filling out your California LLC Articles Of Organization Form online today!

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.