Loading

Get This Cause Coming Before The Court For The Purpose Of The Entry Of A Qualified Illinois Domestic

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the THIS CAUSE Coming Before The Court For The Purpose Of The Entry Of A Qualified Illinois Domestic online

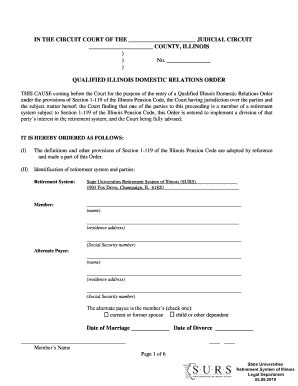

Filling out the Qualified Illinois Domestic Relations Order is an important step in the legal process of dividing retirement benefits. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to fill out the form online:

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in the court information at the top of the form, including the judicial circuit and county name.

- Enter the case number in the designated field.

- Identify the retirement system involved, specifically the State Universities Retirement System of Illinois (SURS), and provide the member's details. Input the full name, residence address, and Social Security number in the respective fields.

- Input the alternate payee’s information, including their name, address, and Social Security number. Select the relationship, either 'current or former spouse' or 'child or other dependent.'

- Fill in the date of marriage and date of divorce in the required sections.

- Specify the payment structure for the alternate payee's benefits. Select one method from the options provided, including entering the specific dollar amount or percentage.

- Indicate when payments to the alternate payee will commence, choosing the appropriate option based on whether the member's benefits have started.

- Choose when the payments will terminate, deciding between death of the member or alternate payee or a specified number of payments.

- Determine whether the alternate payee's share will be recalculated for annual post-retirement increases.

- Address any refunds, lump sum benefits, or death benefits that may accrue to the alternate payee, specifying amounts or percentages accordingly.

- Review the calculations structure in Section IX to ensure proper completion of benefit calculations based on marriage duration.

- Final review: ensure all fields are completed accurately, then save your changes.

- Download, print, or share the form as needed, ensuring you retain a certified copy.

Complete your documents online for a smooth legal process.

Your spouse may be entitled to some of your 401(k). If the account was added to during the marriage, your spouse could get half of that money. There is no set amount of time you have to be married to get the other party's 401(k).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.