Loading

Get Ftb 6274a - Extension Request To File Information Returns ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FTB 6274A - Extension Request To File Information Returns online

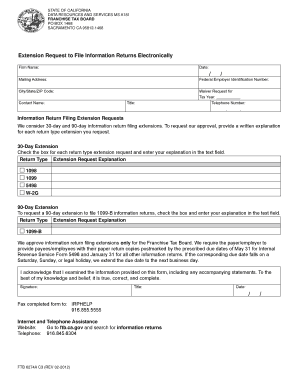

This guide provides clear and supportive instructions on how to complete the FTB 6274A form, which is used to request an extension for filing information returns electronically. By following these steps, users can efficiently navigate the online process.

Follow the steps to complete your extension request efficiently.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your firm's name in the designated field. This identifies the organization submitting the request.

- Fill in the date in the appropriate section to indicate when you are submitting the request.

- Provide your mailing address, including street address, city, state, and ZIP code. This is where correspondence regarding your extension request will be sent.

- Enter your Federal Employer Identification Number (FEIN) accurately, as this identifies your business for tax purposes.

- In the waiver request section, check the applicable boxes for the type of extension you are requesting: either a 30-day or 90-day extension.

- For a 30-day extension, check the boxes next to each return type (1098, 1099, 5498, W-2G) for which you seek an extension and provide a written explanation in the text field.

- If requesting a 90-day extension for filing 1099-B returns, check the appropriate box and provide your explanation in the text field.

- Acknowledge that you have reviewed the information on the form, and that it is accurate by signing in the designated signature field.

- Include your title and the date of signing in the respective fields.

- Finally, fax the completed form to the provided number, ensuring you keep a copy for your records.

Complete your extension request online today to ensure timely filing of your information returns.

Related links form

A paper or electronic copy of the form 1099-NEC must be filed with FTB directly, even if you filed it with the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.