Loading

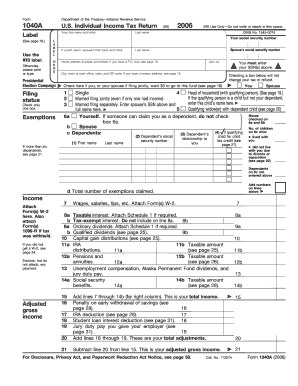

Get 2006 Fillable Irs Form 1040a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 Fillable IRS Form 1040A online

Filing your taxes can be a straightforward process when using the fillable IRS Form 1040A. This guide will help you navigate through the essential components of the form, ensuring you complete it accurately online.

Follow the steps to successfully complete your form online.

- Click the ‘Get Form’ button to access the 2006 Fillable IRS Form 1040A and open it in your preferred document editor.

- Start by filling out the label section, including your first name, last name, and social security number. If filing jointly, also enter your partner’s information in the designated fields.

- Provide your home address, ensuring that all information such as street number, apartment number, city, state, and ZIP code is complete and accurate.

- In the filing status section, select one status that applies to your situation by checking the appropriate box.

- Proceed to the exemptions section. List your dependents by entering their names, social security numbers, and relationships to you in the boxes provided.

- Move on to report your income sources. Attach your Form W-2 if applicable and enter your total income figures as instructed.

- Include any adjustments to your income as specified in the lines dedicated for IRA deductions, student loan interest, and more.

- Calculate your adjusted gross income by following the subtractions specified in the form’s instructions.

- Enter your tax deductions and apply any credits that you qualify for, rounding up your totals as needed.

- Review your total payments and compare them with your calculated tax. Determine if you owe money or are due for a refund.

- Complete the form with your signature and the date. If filing jointly, ensure your partner also signs.

- Finally, you have the option to save your changes, download the completed form, print it for submission, or share it electronically as necessary.

Start filling out your 2006 Fillable IRS Form 1040A online today!

If you can save more in tax by itemizing your deductions instead of taking the standard deduction, you can only do so on a 1040 form since the 1040A doesn't permit you to itemize. The form also limits the types of deductions you can take for purposes of calculating your adjusted gross income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.