Loading

Get P7a Gibraltar

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P7a Gibraltar online

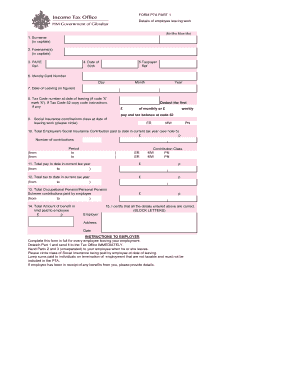

The P7a Gibraltar form is essential for documenting an employee's departure from work and ensuring the correct processing of their tax and social insurance contributions. This guide will provide you with step-by-step instructions on how to effectively complete the P7a form online.

Follow the steps to successfully complete the P7a Gibraltar form.

- Press the ‘Get Form’ button to access the document and open it in your preferred editing tool.

- In section 1, enter the employee's surname in capital letters. Follow this with their forename(s) in section 2, also in capital letters.

- Provide the employee’s PAYE reference number in section 3.

- Fill in the date of birth in section 4, ensuring to format it as Day, Month, and Year.

- Enter the taxpayer reference in section 5 and the identity card number in section 6, following the same date format.

- In section 7, specify the date of leaving the employment in figures.

- For section 8, indicate the tax code number at the date of leaving. If the tax code is 'X', mark 'X'. If the code is '52', follow any additional instructions provided.

- Circle the class of social insurance contributions in section 9 as applicable to the employee.

- In section 10, input the total employee's social insurance contributions paid to date, including the number of contributions and the periods they cover.

- Provide the total pay and total tax to date in the current tax year in sections 11 and 12, respectively.

- If applicable, fill in the total occupational pension or personal pension scheme contributions in section 13.

- Document the total amount of benefits in kind paid to the employee in section 14.

- Finally, certify that all details are correct in section 15 by providing your address and the date.

- Once completed, save changes to the form. You may then download, print, or share it as necessary.

Complete your documents online to ensure a smooth processing experience.

Related links form

The latest list of countries & territories includes the Falklands/Malvinas and Gibraltar among the areas considered tax havens by the Spanish Government, allegedly involved in crimes such as money laundering.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.