Loading

Get Ny Char500 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CHAR500 online

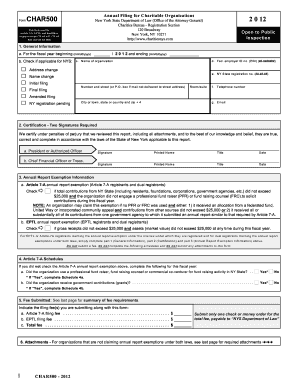

Filing the NY CHAR500 accurately is essential for complying with New York State regulations for charitable organizations. This guide provides clear, step-by-step instructions to help users fill out this form online with confidence.

Follow the steps to complete your NY CHAR500 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the general information section. Provide the fiscal year start date and the name of the organization. Make sure to include your Federal Employer Identification Number (EIN) and the New York State registration number if applicable.

- Complete the certification section. This part requires signatures and printed names of two authorized individuals, such as the president and the chief financial officer. Ensure that dates are provided for the signatures.

- If claiming an exemption from the annual report, complete the exemption information section. Indicate if your organization qualifies under Article 7-A and EPTL by checking the appropriate boxes.

- If you do not qualify for an exemption, complete the Article 7-A schedules. Answer questions related to the use of professional fundraisers and government contributions. Provide necessary details for each schedule if applicable.

- Review the fee submission section. Determine if you need to pay any filing fees based on your organization type and total support and revenue. Enter the correct fees where required.

- Attach any required documentation, such as IRS Form 990 and appropriate schedules. Follow the checklist provided to ensure you include all necessary attachments.

- Once all sections are completed, save your changes in the document. You can then download, print, or share the completed form as needed.

Start filling out your NY CHAR500 online today to ensure compliance with state regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing the NY CHAR500 online is a straightforward process through the New York Department of State's website. You will need to create an account to access the online filing system. Once logged in, simply follow the prompts to complete your CHAR500 form and submit it electronically, streamlining your compliance efforts.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.