Loading

Get Form Due On - Ato Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

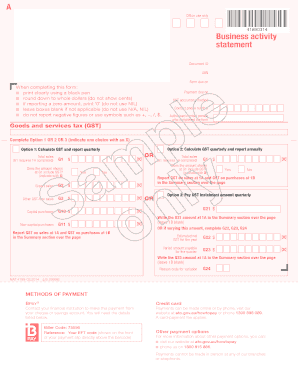

How to fill out the Form Due On - Ato Gov online

This guide provides clear and comprehensive instructions for completing the Form Due On - Ato Gov online. It aims to assist all users, regardless of their prior experience with tax forms.

Follow the steps to complete your Form Due On effectively.

- Press the ‘Get Form’ button to access the online form and open it in your editing interface.

- Begin by entering your Australian Business Number (ABN) in the appropriate field, as this identifies your business.

- Review the business activity statement section and select the applicable GST accounting method by indicating your choice with an 'X' for either quarterly or annual reporting.

- In the total sales section (G1), record your total sales amount. Ensure the amount is rounded down to the nearest whole dollar, omitting any cents.

- Indicate whether the total sales amount includes GST by marking the corresponding 'Yes' or 'No' box.

- Fill out the export sales (G2) and other GST-free sales (G3) sections by inputting the relevant amounts rounded down to whole dollars.

- Input capital purchases in the G10 field and non-capital purchases in the G11 field.

- If applicable, complete the summary section by reporting GST amounts from sections 1A and 1B.

- Proceed to provide details for PAYG tax withheld, including total salary and wages, as well as the amounts withheld from these payments.

- Complete the PAYG instalment section by either choosing to pay a quarterly instalment or calculating based on income.

- If required, indicate any reason for variations in reported amounts with appropriate codes.

- Verify that all fields are completed accurately without using symbols like +, −, or $ and ensure to use a black pen if filling out a physical copy.

- Finally, review your completed form for accuracy, save any changes made, and choose to download, print, or share the form as needed.

Complete your Form Due On online today to ensure timely and accurate filing!

Related links form

You can find your income statement in ATO online services through myGov or the ATO app. Your income statement will show your year-to-date: salary and wages. tax that has been withheld. super.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.