Loading

Get Seychelles Revenue Commission Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Seychelles Revenue Commission Form online

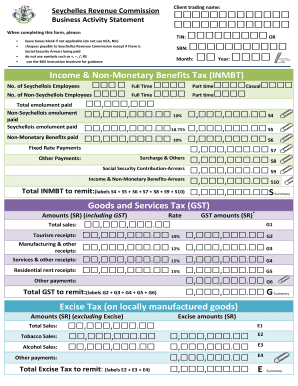

Filling out the Seychelles Revenue Commission Form is an essential step for ensuring compliance with local tax regulations. This guide provides clear and supportive instructions for completing the form online, helping users navigate its various sections efficiently.

Follow the steps to complete the form successfully

- Click ‘Get Form’ button to obtain the Seychelles Revenue Commission Form and open it in your preferred document editor.

- Input the client trading name in the designated field. If applicable, leave boxes blank instead of using 'N/A' or 'NIL'.

- Enter your Tax Identification Number (TIN) in the appropriate field, or alternatively provide your Seychelles Business Number (SBN).

- Specify the month and year related to the reporting period by filling in the corresponding fields.

- Complete the 'Income & Non-Monetary Benefits Tax' section, indicating employee types and total emoluments paid.

- Detail the 'Goods and Services Tax (GST)' by filling in amounts for total sales and respective categories like tourism receipts.

- Provide the necessary figures under the 'Excise Tax' section by detailing sales for locally manufactured goods.

- Fill out the 'Pay As You Go (PAYG)' section with the amounts paid for dividends, royalties, interest, and specified businesses.

- Summarize your totals for INMBT, GST, Excise Tax, and PAYG before proceeding to the final confirmation.

- Once all information is accurately completed, save your changes, download a copy of the form, print it for your records, or share it as needed.

Complete your tax obligations by filling out the Seychelles Revenue Commission Form online today.

In Seychelles, profits earned by Seychelles companies through permanent establishments located overseas are not subject to taxation. However, profits earned through foreign activities that do not establish a permanent presence abroad are taxable in Seychelles.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.