Get Probenefits Dependent Care Receipt Form 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ProBenefits Dependent Care Receipt Form online

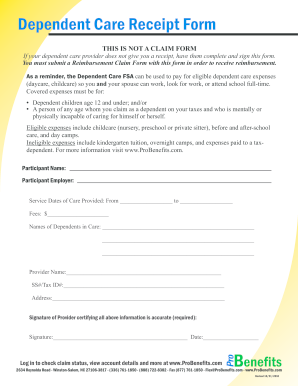

Completing the ProBenefits Dependent Care Receipt Form online is an essential step for anyone seeking reimbursement for eligible dependent care expenses. This guide will provide you with clear and supportive instructions to navigate each section of the form effectively.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing platform.

- In the 'Participant Name' section, enter your full name as the participant requesting reimbursement.

- In the 'Participant Employer' field, fill in the name of your employer or organization that sponsors your dependent care plan.

- Indicate the 'Service Dates of Care Provided' by entering the start and end date of the care in the designated spaces.

- In the 'Fees' section, specify the total amount you are claiming for reimbursement, written clearly in the provided field.

- List the 'Names of Dependents in Care' by including each child or dependent's name for whom the care was provided.

- Complete the 'Provider Name' field by entering the full name of the care provider who has offered the services.

- In the 'SS#/Tax ID#' section, insert the social security number or tax ID of the care provider for verification purposes.

- Fill out the address of the care provider in the designated section for identification.

- The care provider must then sign on the line provided, certifying that all entered information is accurate and truthful, along with dating the form.

- After filling out the form, review all sections for accuracy. You can then save changes, download, print, or share the completed form as needed.

Take the time to complete your ProBenefits Dependent Care Receipt Form online today to ensure timely reimbursement for your eligible expenses.

Related links form

A proof of payment for your dependent care FSA is typically a receipt or detailed invoice from your care provider. This document should show the date of payment, the amount, and the services rendered. Utilizing the ProBenefits Dependent Care Receipt Form can help streamline the process of gathering this proof and ensure you meet the necessary requirements for reimbursement.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.