Loading

Get Or 150-211-055 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 150-211-055 online

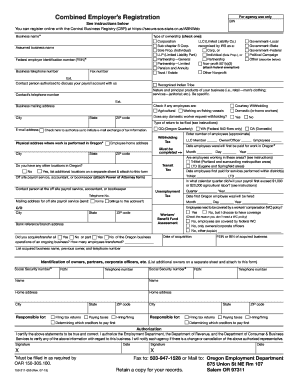

Filling out the OR 150-211-055 is essential for individuals or firms registering as employers in Oregon. This guide provides comprehensive, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the OR 150-211-055 online.

- Press the ‘Get Form’ button to download the form and open it for editing.

- Enter your business name in the designated field. Ensure that the name reflects your registered business.

- Identify the type of ownership by checking the appropriate box. Options include Corporation, LLC, Government, Sole Proprietorship, and other types listed.

- Provide your assumed business name if it differs from your actual business name.

- Fill in your federal employer identification number (FEIN) and any applicable fax and business telephone numbers.

- Designate a contact person authorized to discuss your payroll account. Include their contact number.

- Describe the nature and principal products of your business in Oregon. Be as specific as possible.

- Fill in the contact information for the person dealing with the payroll service or accountant.

- Specify your physical business address and mailing address if different. Provide the city, state, and ZIP code.

- Indicate if there are any employees working in specialized sectors such as agricultural or on fishing vessels.

- Complete the section regarding withholding, including any domestic workers who request withholding.

- Fill in the dates regarding when employees were first paid for work in Oregon, including important figures such as total payroll and the number of employees.

- Complete the identification section for owners, partners, or corporate officers, ensuring to include Social Security numbers and contact information.

- Certify the information provided is correct by signing and dating the form. Fax or mail it as instructed.

- Save your completed form and consider downloading or printing it for your records.

Start filling out your OR 150-211-055 online today to ensure smooth registration as an employer in Oregon.

Yes, you can file your tax return by yourself, especially if you feel comfortable managing your financial information. Many find tools like uslegalforms helpful, as they provide everything you need to comply with OR 150-211-055. By following their comprehensive instructions, you can successfully navigate the filing process without assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.