Loading

Get Printable W 8 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Printable W 8 Form online

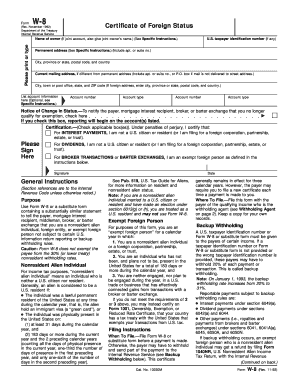

Filling out the Printable W 8 Form is an important step for nonresident aliens and foreign entities seeking to claim exemption from certain U.S. tax withholding rates. This guide will provide you with a comprehensive overview of each section of the form and the necessary steps to complete it online.

Follow the steps to accurately complete the form online

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the name of the owner in the designated field. If it is a joint account, include the joint owner's name as well.

- If you have a U.S. taxpayer identification number, please provide it in the next section; otherwise, leave it blank.

- Fill in your permanent address, including any apartment or suite number, as well as the city, province or state, postal code, and country.

- If your current mailing address is different from your permanent address, provide it in the specified area.

- Optionally, list account information such as account numbers and types if you have multiple accounts with the same payer.

- If there is a change in your status, check the box to notify the payer about this change.

- In the certification section, check the applicable boxes that describe your status regarding U.S. citizenship or residency.

- Sign and date the form in the indicated area to validate the information provided.

- After completing the form, save your changes, and proceed to download, print, or share the form as necessary.

Complete your documents online today for a streamlined process.

Guide To Fill W-8 BEN Form for Investing in US Stocks Step 1: Enter Legal Name. ... Step 2: Mention your Current Citizenship. ... Step 3: Permanent Address. ... Step 4: Mailing Address. ... Step 5: U.S. Taxpayer Identification Number. ... Step 6: Foreign Tax Identifying Number. ... Step 7: Reference Number. ... Step 8: Date Of Birth.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.