Loading

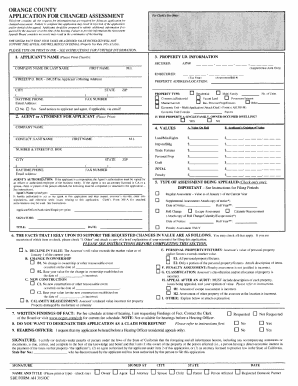

Get Ca Sbe Ah 305/oc 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA SBE AH 305/OC online

Filling out the CA SBE AH 305/OC form online can be a manageable process with the right guidance. This guide provides clear instructions on each section of the form to help you complete it accurately and efficiently.

Follow the steps to complete the CA SBE AH 305/OC online.

- Click the ‘Get Form’ button to retrieve the form and open it in your document editor.

- Begin by entering your personal information in the designated fields. This typically includes your full name, address, and contact details. Ensure that all information is accurate to avoid complications.

- Continue to the next section where you may need to provide additional specific details related to your application or request. Carefully read any instructions to clarify what information is required.

- Review any sections that may require you to select options or provide numerical data. Ensure you understand each choice and provide clear answers.

- As you fill out the form, be sure to double-check for any missed fields or errors. It can be helpful to compare your entries with any supporting documents you may have.

- Once you have completed all the sections of the form, look for options to save your changes or to download and share the completed form. This ensures your submission is properly finalized.

Start completing your documents online today.

Qualifications for filing an exemption in California can vary based on the type of exemption. Generally, individuals may be eligible based on their age, disability status, or income. It's important to review each exemption's specific requirements to determine your eligibility. For detailed qualifications, refer to the information found in CA SBE AH 305/OC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.