Loading

Get Risk Tolerance Questionnaire - Etrade

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RISK TOLERANCE QUESTIONNAIRE - ETRADE online

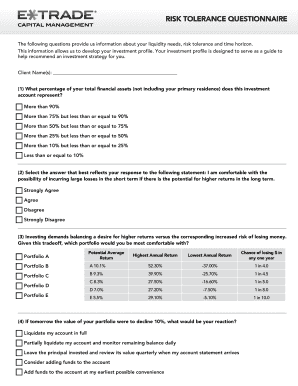

Completing the RISK TOLERANCE QUESTIONNAIRE is a crucial step in understanding your investment preferences and risk exposure. This guide provides you with clear, step-by-step instructions to ensure that you navigate the questionnaire effectively and accurately.

Follow the steps to complete the questionnaire with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your Client Name(s) at the top of the form. This identifies the individual or individuals completing the questionnaire.

- For the first question, indicate the percentage of your total financial assets (excluding your primary residence) that this investment account represents. Choose one of the provided ranges.

- Answer the second question regarding your comfort with the possibility of incurring large losses for potential higher long-term returns by selecting from 'Strongly Agree' to 'Strongly Disagree'.

- In the third question, choose the portfolio that aligns with your investment comfort level based on the provided potential returns and risks.

- Respond to the fourth question regarding your reaction to a 10% decline in portfolio value based on the options given.

- For the fifth question, indicate how you view generating income with this account, from 'not a goal' to 'maximizing income'.

- Answer the sixth question about your intent to use income or principal for living expenses, indicating your timeline for withdrawals.

- In the seventh question, specify the percentage of your current living expenses you expect to meet with income or principal from this account.

- Respond to the eighth question regarding your plans for future withdrawals and the timing of those withdrawals.

- In the ninth question, relay your expectations for the duration of withdrawals once you begin.

- Answer the tenth question about your attitude towards investments and inflation, selecting from various risk levels and expectations.

- Choose your preferred investment products in the eleventh question, selecting from mutual funds, ETFs, or both.

- Decide on the tax-sensitive portfolio preference in the twelfth question and select your response based on applicability.

- Once you have completed all questions, review your responses for accuracy. Then, you can save your changes, download, print, or share the completed questionnaire.

Complete your RISK TOLERANCE QUESTIONNAIRE online today to better understand your investment profile.

Related links form

To place a naked equity call or put trade (Levels 3 and 4) you must have margin equity of at least $5,000 in your margin account. At Levels 3 and 4, margin customers will be allowed to enter naked short put positions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.