Loading

Get Schedule R (form 941) (rev. March 2024)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule R (Form 941) (Rev. March 2024) online

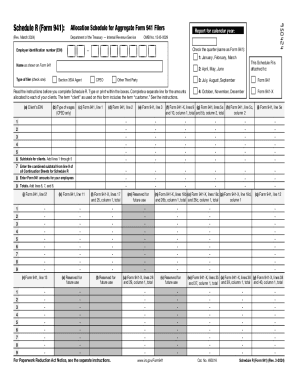

Filling out the Schedule R (Form 941) online can streamline your reporting process, especially if you are an employer with multiple clients. This guide provides a clear, step-by-step approach to ensure you complete the form accurately.

Follow the steps to complete Schedule R efficiently.

- Press the ‘Get Form’ button to obtain the form and access it in the editor.

- Enter your Employer Identification Number (EIN) at the top of the form as required for identification purposes.

- Indicate the calendar year for which you are reporting by filling in the designated area.

- Select the quarter of the year that corresponds with your reporting period by checking the appropriate box.

- Complete the client information by entering each client’s EIN in column (a) and specifying their type of wages if applicable in column (b).

- For each client, provide the amounts from Form 941, lines 1 to 8 in the respective columns (c) to (h).

- After entering the amounts, add the subtotals for all clients in line 6, which must include lines 1 through 5.

- Transfer the combined subtotal from line 9 of your continuation sheets for Schedule R into line 7.

- Enter the Form 941 amounts for your employees in line 8 to ensure complete reporting.

- Finally, calculate and total all amounts by adding lines 6, 7, and 8, and place the final total in line 9.

- Once you have filled out all necessary fields, you can choose to save your changes, download, print, or share the completed form as needed.

Start filing your Schedule R online today for a smoother documentation process.

The Schedule R (Form 941) will provide the IRS with client-specific information to support the totals reported on an aggregate Form 941. It includes an allocation line for each client showing a breakdown of their wages and employment tax liability for the tax period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.