Loading

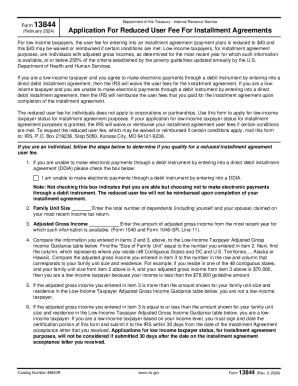

Get Form 13844 (rev. 2-2024)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13844 (Rev. 2-2024) online

Filling out the Form 13844 (Rev. 2-2024) online can be a straightforward process if you follow the necessary steps carefully. This guide provides clear and comprehensive instructions to help you complete the application for a reduced user fee for installment agreements effectively.

Follow the steps to complete your Form 13844 online.

- Click ‘Get Form’ button to obtain the form and open it in the designated form editor.

- Begin with the personal information section. Enter your name (Last, First, Middle Initial) in the provided fields.

- Fill in your Social Security Number (SSN) or Taxpayer Identification Number (TIN) in the corresponding field. If you are filing jointly, do the same for your spouse’s name and SSN or TIN.

- Indicate if you are unable to make electronic payments through a debit instrument by checking the appropriate box. This is important for determining eligibility for fee reimbursement.

- In the family unit size section, enter the total number of dependents, including yourself and your spouse, claimed on your most recent tax return.

- Input your adjusted gross income from the most recent year available, referencing Line 11 from Form 1040 or Form 1040-SR.

- Compare your entered family unit size and adjusted gross income against the Low-Income Taxpayer Adjusted Gross Income Guidance table to determine eligibility.

- If your adjusted gross income is at or below the relevant guideline amount based on your family unit size and residence, you qualify as a low-income taxpayer.

- Sign and date the certification section of the form, confirming that you meet the eligibility criteria. If applicable, your spouse should also sign and date.

- After completing the form, ensure to save your changes, and then you can download, print, or share the form securely.

Take the next step towards your financial relief by completing the Form 13844 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can choose to pay off your IRS installment agreement early or to pay more than the required monthly payment. You must pay at least the minimum monthly payment, but you are welcome to pay more than that amount.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.