Loading

Get Wdva 2366 - Notice Of Default And Customer's Right To Cure Default

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WDVA 2366 - Notice Of Default And Customer's Right To Cure Default online

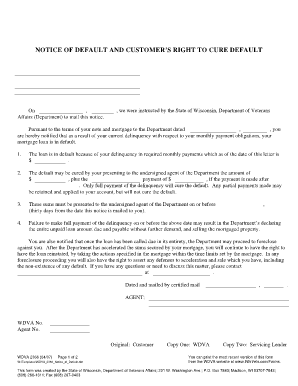

The WDVA 2366 form serves as an important legal document notifying individuals of their mortgage loan's default status and their right to remedy it. This guide provides clear, step-by-step instructions for completing this form online.

Follow the steps to fill out the WDVA 2366 form accurately and effectively.

- Press the ‘Get Form’ button to access the WDVA 2366 form and open it in the online editor.

- Begin by entering the mortgagor’s name and the property address, including city, state, and zip code, in the designated fields.

- Fill in the date you were instructed by WDVA to mail the notice in the provided space.

- Input the date when the mortgage note and mortgage were executed. Ensure accuracy to avoid issues.

- Clearly indicate the amount of escrow, principal, and interest that is delinquent as of the date of this notice.

- Specify the conditions required to cure the delinquency, including any required payments.

- Complete the deadline by which payment must be made, which is typically thirty days from the mailing date of this notice.

- Provide the name and phone number of the servicer’s contact person for further inquiries regarding the notice.

- Document the date the notice is being mailed to the mortgagor by certified mail in the appropriate section.

- Fill in the agent’s details, including the servicer's name and address, and complete the sections for WDVA No. (Loan Number) and Agent No. (Servicer Number).

- After completing all fields, review the form for accuracy and completeness before saving your changes.

- Finally, download, print, or share the completed form as needed to ensure proper distribution.

Complete your WDVA 2366 form online today to ensure timely submission and prevent further complications.

The notice must tell you that you are in default and that you have 30 days to cure the default. The Right to Cure Notice says that if you do not get caught up on your payments, “cure your default,” the bank can begin foreclosure proceedings to take your house.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.