Loading

Get Ca Rh 2261n 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA RH 2261N online

This guide provides comprehensive instructions on completing the CA RH 2261N form online. Whether you are new to the process or need a refresher, these clear steps will help you navigate each section with confidence.

Follow the steps to successfully complete your registration

- Click ‘Get Form’ button to access the CA RH 2261N form digitally.

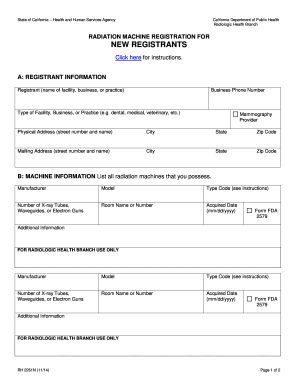

- In section A, provide your registrant information. This includes the name of your facility, business, or practice, your business phone number, and the type of facility (e.g. dental, medical, veterinary). Fill in the physical address, including street number, city, state, and zip code. Additionally, enter the mailing address if it differs from the physical address.

- For section B, list all radiation machines you own. You will need to specify details such as the manufacturer, model, type code (as defined in the instructions), number of X-ray tubes, waveguides, or electron guns, the room name or number where the equipment is located, and the acquired date formatted as mm/dd/yyyy.

- In section C, enter the contact information for the person that Radiologic Health Branch representatives can reach for any queries. Provide their name, phone number, and email address.

- Move to section D, where an authorized representative must sign the form. They should print their name, title or position, provide their signature, and the date of signing.

- For section E, ensure all pages of the form are submitted. Be sure to keep a copy for your records. Only submit the original form with supporting documents to the designated address provided in this section. Remember that no payment is required at this time.

Complete your CA RH 2261N registration online today for a smoother process.

To complete a California resale certificate, start with your business name and seller’s permit number at the top. Next, describe the types of items you will be purchasing for resale. Make sure to sign and date the certificate, as this solidifies your commitment to the accuracy of the information provided. Resources such as CA RH 2261N can simplify this process, ensuring you are prepared for any potential audits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.