Loading

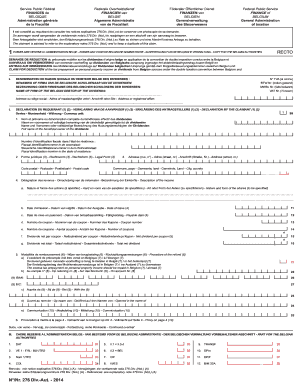

Get Be N°/nr. 276 Div.-aut. 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BE N°/Nr. 276 Div.-Aut. online

Filling out the BE N°/Nr. 276 Div.-Aut. form can seem complicated, but with the right guidance, it can be a straightforward process. This guide will provide you with step-by-step instructions to successfully complete the form online, ensuring that you understand each section and provide accurate information.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the full name of the Belgian debtor of the dividends in the provided space.

- Fill in the address of the registered office of the Belgian debtor. This includes the street, postal code, city, and country.

- In the declaration section, indicate the currency that is relevant for your application.

- Provide the full name of the beneficial owner of the dividends, along with their VAT number if known.

- Complete the fiscal identification number in the state of residence of the beneficial owner.

- Specify the legal form of the beneficial owner, such as individual, corporation, etc.

- Detail the nature and form of the shares generating the dividends, including the date of issue and payable date.

- Indicate the number of coupons and the net dividend per coupon, as well as the total net dividend.

- Describe the procedure for refunding any excess tax prepayment on dividends, specifying whether it should be returned in Belgium or abroad.

- Complete the signature section with the date and signature of the beneficial owner or their representative.

- Finally, review your filled-out form for accuracy, then save your changes, download a copy, print it if necessary, or share it according to your needs.

Start completing the BE N°/Nr. 276 Div.-Aut. online now!

The withholding tax rate in Belgium can vary depending on the type of income. For salary payments, the rate typically reflects progressive tax brackets. By understanding the key elements of BE N°/Nr. 276 Div.-Aut., you can navigate withholding tax calculations with greater confidence, ensuring that your withholdings are accurate and compliant with current regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.