Loading

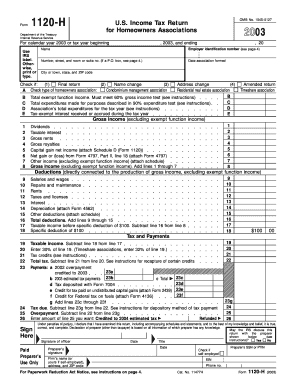

Get 2003 Form 1120 H

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2003 Form 1120 H online

Completing the 2003 Form 1120 H is essential for homeowners associations seeking to file their U.S. income tax return accurately. This guide provides clear, step-by-step instructions to help you navigate each section of the form online with confidence.

Follow the steps to fill out the Form 1120 H effectively

- Press the ‘Get Form’ button to obtain the form and access it on your device.

- Enter the name of the homeowners association in the designated field. This is a critical step to identify your organization.

- Fill in the address section, including the number, street, room or suite number. If applicable, use a P.O. box.

- Provide the employer identification number (EIN) if available. If not, state 'Applied for' in the EIN section.

- Indicate the date the association was formed and ensure the city, state, and ZIP code are accurately filled in.

- Check the appropriate boxes to indicate if this is the final return, a name change, or an amendment.

- Complete the gross income section by providing total exempt function income and expenditures. This demonstrates compliance with IRS income tests.

- Enter details under gross income, listing types such as dividends, interest, rents, and other incomes, and sum these figures.

- Provide deductions related to gross income and then calculate taxable income.

- Fill out the tax and payments section, including total tax owed and any payments made towards estimated taxes.

- Sign and date the form in the designated area, ensuring the declaration is filled out completely.

- Once completed, you can save the changes to the document, download a copy for your records, print, or share it as needed.

Start completing your Form 1120 H online today to ensure timely and accurate filing.

Related links form

Late filing tax penalties are one of the steepest. For any tax balance, the HOA will be penalized 5% of the unpaid tax liability for each month the return is late. This penalty is capped at 25%. There is also a minimum penalty for any return that is over 60 days late that is the smaller of the tax due or $205.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.