Get Reasonable Explanation Form - Aib

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Reasonable Explanation Form - AIB online

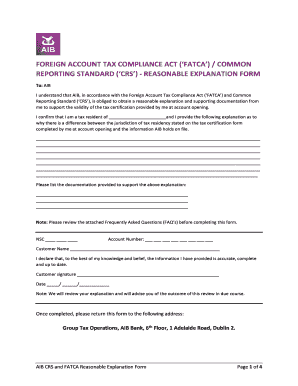

This guide provides users with the necessary information and steps to effectively complete the Reasonable Explanation Form - AIB online. By following these instructions, users can ensure that their form is accurately filled out to meet the requirements of the Foreign Account Tax Compliance Act and the Common Reporting Standard.

Follow the steps to fill out the Reasonable Explanation Form - AIB online:

- Click the ‘Get Form’ button to obtain the Reasonable Explanation Form - AIB and open it in your preferred editor.

- In the designated section, indicate your tax residency by filling in the blank where it states "I confirm that I am a tax resident of _______________________." Be specific and ensure that the information you provide aligns with your tax residency status.

- Provide a detailed explanation for the differences between your stated tax residency and the information held by AIB. Use clear and precise language to cover all relevant details.

- List any documentation that supports your explanation in the section provided. This documentation might include items such as utility bills, tax assessments, or other relevant materials.

- Fill in your account number and customer name accurately to ensure proper identification.

- In the declaration section, confirm the accuracy of your provided information by signing and dating the form. This certification indicates your understanding of the responsibilities surrounding the information provided.

- Once the form is complete, save your changes and download the document for your records. You may also print it or share it as necessary to submit to AIB.

Ensure that your documentation is complete and submit your Reasonable Explanation Form - AIB online today.

Revenue can provide you with a Letter of Residence. This is to confirm your tax residency to a foreign tax authority with which Ireland has a Double Taxation Agreement. You cannot use a Letter of Residence for any other purposes. You can request a Letter of Residence through the 'Manage My Record' portal in myAccount.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.