Loading

Get Sg W.45(a) 2004-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SG W.45(A) online

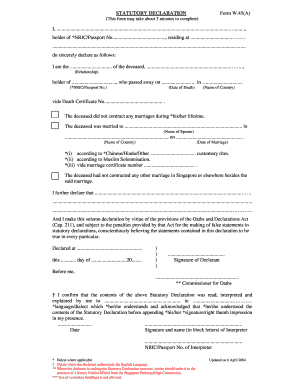

Filling out the SG W.45(A) statutory declaration form online can be a straightforward process when you have the right guidance. This guide provides clear, step-by-step instructions to help you complete the form efficiently and accurately.

Follow the steps to fill out the SG W.45(A) form online:

- Press the ‘Get Form’ button to access the SG W.45(A) form and open it in the editor.

- Begin by entering your name as the declarant in the designated section.

- Provide your *NRIC or Passport number, followed by your residential address in the respective fields.

- In the relationship section, specify how you are related to the deceased.

- Enter the name of the deceased, their identification number, and the date and place of their passing.

- Indicate whether the deceased was married and detail the spouse's name, the marriage date, and the country of marriage.

- Select the appropriate marital customs or solemnization method—choose from Chinese, Hindu, Other, or Muslim Solemnisation.

- Affirm that the deceased did not enter into any other marriages by checking the appropriate box.

- Complete any additional declarations as prompted in the form, ensuring all statements are true to the best of your knowledge.

- After filling out the form, review all the information for accuracy, then save your changes, and choose to download, print, or share the completed SG W.45(A) as needed.

Complete your SG W.45(A) form online today for a seamless experience.

Certain payments are exempt from Singapore withholding tax, including specific types of income, such as dividends or capital gains. Understanding the nuances of exemptions under SG W.45(A) is essential for compliance and financial planning. Discovering these exemptions can significantly benefit your financial strategy, and uslegalforms can guide you through identifying applicable exemptions with confidence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.