Loading

Get Form 8384

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8384 online

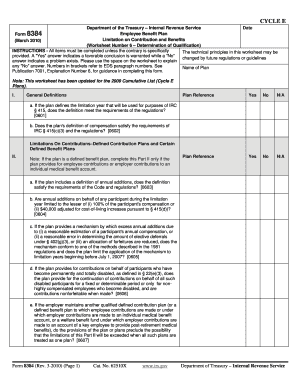

Filling out the Form 8384 online is a crucial task for anyone involved in managing employee benefit plans. This guide will walk you through the essential steps to ensure you complete the form accurately and effectively.

Follow the steps to complete Form 8384 online.

- Press the ‘Get Form’ button to acquire the form and access it in the online editor.

- Begin by entering the name of the plan in the designated field. Ensure that this accurately reflects the official title of your employee benefit plan.

- In Part I, respond to the general definitions regarding the limitation year and compensation definition according to IRC regulations. Answer 'Yes', 'No', or 'N/A' as applicable. If answering 'No', use the space provided to explain your answer.

- Proceed to Part II if applicable. Here, address limitations on contributions by checking the relevant boxes—again, provide explanations for any 'No' answers in the space provided.

- Move to Part III, focusing on limitations on benefits if you are filling out the section for defined benefit plans. Check the applicable fields and provide necessary explanations if there are any 'No' responses.

- Review all filled sections for accuracy. Ensure that entries meet the requirements specified in regulations.

- Once completed, save your changes. You have the option to download, print, or share the completed form as required.

Complete your Form 8384 online to ensure compliance with employee benefit regulations.

There is no specific charitable donations limit without a receipt, you always need some sort of proof of your donation or charitable contribution. For amounts up to $250, you can keep a receipt, cancelled check or statement. Donations of more than $250 require a written acknowledgement from the charity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.