Get Canada Goods And Services Tax/harmonized Sales Tax (gst/hst) Return Working Copy

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada Goods and Services Tax/Harmonized Sales Tax (GST/HST) Return Working Copy online

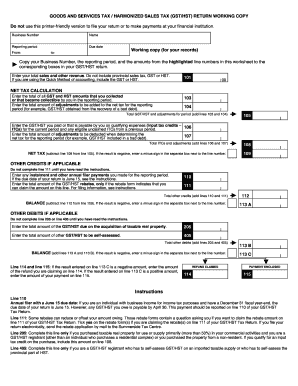

Filling out the Canada Goods and Services Tax/Harmonized Sales Tax (GST/HST) Return Working Copy is an important step in managing your business taxes. This guide will provide a clear and detailed walkthrough to assist you in completing the form correctly and efficiently online.

Follow the steps to accurately complete your GST/HST return working copy.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter your business number and name in the designated fields at the top of the form.

- Specify the reporting period by filling in the 'From' and 'To' dates accordingly.

- Record your total sales and other revenue in the appropriate section. Ensure not to include provincial sales tax, GST, or HST.

- For net tax calculation, enter the total GST and HST collected during the reporting period, including any adjustments to be added.

- Document the total GST/HST paid on qualifying expenses as input tax credits (ITCs) and any eligible unclaimed ITCs from previous periods.

- Calculate the net tax by subtracting total ITCs and adjustments from the total GST/HST collected.

- If applicable, enter any credits for instalments and GST/HST rebates you are entitled to claim.

- Complete the other debits section only if relevant, including any GST/HST due on real property acquisition.

- Finalize your return by determining whether you are claiming a refund or submitting a payment.

- Review all entries for accuracy, then save or download your completed form for your records.

Begin the process now by completing your GST/HST return online.

GST in Canada is generally set at 5%, while HST ranges from 13% to 15%, depending on the province. It is crucial to verify the current rates prior to transactions. Using a Canada Goods and Services Tax/Harmonized Sales Tax (GST/HST) Return Working Copy can streamline your understanding of these taxes when filing your returns.

Fill Canada Goods and Services Tax/Harmonized Sales Tax (GST/HST) Return Working Copy

If you own or operate a business in Canada, you need to know about the goods and services tax (GST) and the harmonized sales tax (HST). Administration of the Harmonized Sales Tax (HST). A fillable GST Return Form is available for download through the link below.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.