Loading

Get Va 760c 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA 760C online

Filling out the VA 760C form online can streamline the process of calculating underpayment for Virginia estimated tax. This guide provides a step-by-step approach to effectively complete each section of the form, ensuring you provide the necessary information accurately.

Follow the steps to complete the VA 760C form online.

- Click the ‘Get Form’ button to access the VA 760C and open it in the editor.

- Begin by entering the fiscal year dates at the top of the form, specifying the beginning and ending dates for the tax period covered.

- Input your name, or the name of the estate or trust, along with the appropriate Social Security Number or FEIN.

- If filing for an estate or trust, provide the name and title of the fiduciary, and include your spouse's Social Security Number if applicable.

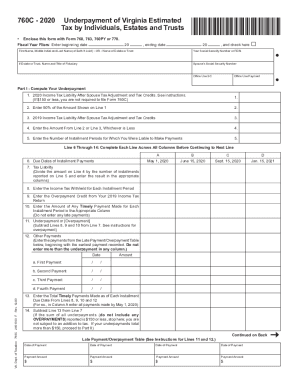

- In Part I, calculate your underpayment by first documenting your 2020 income tax liability after applicable adjustments and credits.

- Proceed to compare your current year's tax liability with either 90% of the current liability or the previous year’s tax liability. Record the lower of the two in the designated field.

- List the due dates of your installment payments and compute your tax liability for each installment based on the total number of payments due, filling in the respective columns.

- Document any income tax withheld, overpayment credit from the previous tax year, and timely payments made, ensuring these totals match the installment dates.

- Calculate your total timely payments made by summing the documented amounts, then subtract this from your computed tax liability to identify any underpayment.

- Complete Part II, marking any exceptions that may apply to your tax situation to potentially void further penalties, and provide the necessary calculations based on the guidelines.

- In Part III, compute any addition to tax, ensuring to follow the instructions closely and record your findings in each column.

- After completing each part of the form, you have the option to save your changes, download, print, or share the completed form as needed.

Start filling out your VA 760C form online today for a seamless tax filing experience.

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.