Loading

Get Ira Distribution Request - Ccar

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRA Distribution Request - CCAR online

The IRA Distribution Request - CCAR is an essential form for managing distributions from your retirement accounts. This guide provides clear, step-by-step instructions to help you confidently complete the form online.

Follow the steps to fill out the IRA Distribution Request - CCAR online.

- Click ‘Get Form’ button to obtain the IRA Distribution Request - CCAR and open it in your preferred online editor.

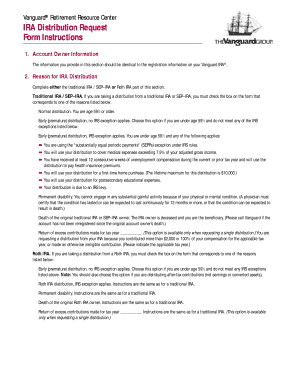

- Fill in the account owner information section. This should match the registration details of your Vanguard IRA, including your name, Social Security number, and contact information.

- Complete the reason for IRA distribution section. Choose whether your distribution is from a traditional IRA/SEP-IRA or a Roth IRA and check the appropriate box for your situation. Ensure you understand each reason's qualifications and implications.

- Indicate your method of distribution. Decide if you wish to receive installment distributions or a single distribution. For installments, provide dates and frequency, and for single distributions, select either total or partial payment.

- Specify income tax withholding preferences. Decide whether to withhold federal income tax from your IRA distribution and indicate the percentage if applicable.

- Provide payment instructions. Choose to have funds deposited into an existing account or mailed to your address. If selecting special payment instructions, provide necessary details and attach required documents.

- Sign the form in the designated area and date it. Your signature must be exact as per your Vanguard IRA registration.

- Complete the signature guarantee section if you opted for special payments. Obtain a signature guarantee from an authorized institution.

- Review the completed form for accuracy, save any changes, and prepare for submission. You can download, print, or share the form as needed.

Begin filling out the IRA Distribution Request - CCAR online today for a smooth distribution process.

Coming into a Schwab branch directly. Calling us to request a distribution verbally at 866-855-5636. Submitting an IRA Distribution form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.