Loading

Get Nj Nj-w-3m 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-W-3M online

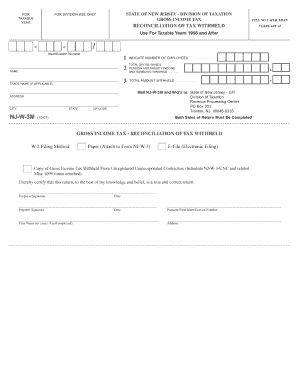

Filling out the NJ NJ-W-3M form is an essential step in reconciling tax withheld for employees in New Jersey. This guide will provide you with detailed, step-by-step instructions on how to complete the form online, ensuring that you understand each component and can submit it accurately.

Follow the steps to complete the NJ NJ-W-3M online.

- Press the ‘Get Form’ button to access the NJ NJ-W-3M form and open it in the document editor.

- Begin by entering the identification number at the top of the form. This number is crucial for processing the reconciliation.

- Indicate the total number of employees on line 1. Make sure to count all employees that your organization has.

- On line 2, enter the total gross wages, pension and annuity income, and gambling winnings. Be thorough to ensure all amounts are included.

- Next, record the total amount withheld on line 3. This figure represents the total taxes that have been withheld from the employees.

- Fill in the name, trade name (if applicable), and address fields. This identifies your organization and provides necessary contact information.

- Complete the city, state, and ZIP code fields to ensure proper localization of the tax return.

- Choose the W-2 filing method: indicate if you are filing by paper or electronically. Make sure to follow any attached instructions based on your choice.

- Certify the return by signing in the specified areas for both the taxpayer and the preparer if one is involved, including dates.

- Finally, save your changes, and download or print the completed form to file it as required.

Complete your NJ NJ-W-3M form online today for accurate tax reconciliation.

Your New Jersey employer is responsible for withholding FICA taxes and federal income taxes from your paychecks....Income Tax Brackets. Single FilersNew Jersey Taxable IncomeRate$35,000 - $40,0003.500%$40,000 - $75,0005.525%$75,000 - $500,0002 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.