Loading

Get Hsbc Crs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hsbc Crs online

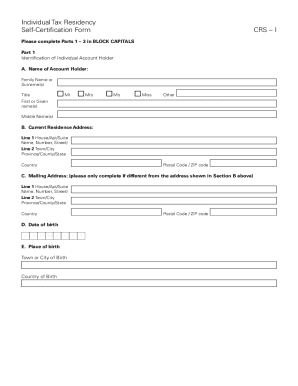

The Hsbc Crs Individual Self-Certification Form is essential for gathering tax residency information required by governments globally. This guide will provide step-by-step instructions on filling out the form correctly to ensure compliance with the Common Reporting Standard.

Follow the steps to complete the Hsbc Crs form online.

- Click ‘Get Form’ button to access the Hsbc Crs Individual Self-Certification Form and open it in your editor.

- In Part 1, provide your identification information. Fill in your family name, title, first name, and middle name in BLOCK CAPITALS. Then, enter your current residence address, including all relevant details such as house or apartment number, street, town or city, province or county, country, and postal code/ZIP code.

- If your mailing address differs from your current residence address, complete the mailing address section; otherwise, leave it blank.

- In Part 1D, indicate your date of birth in the format DD/MM/YYYY and provide your place of birth, including the town or city and country.

- In Part 2, indicate your country of residence for tax purposes. Fill out the corresponding table with the country name and your Taxpayer Identification Number (TIN). If no TIN is available, select and explain the appropriate reason.

- In Part 3, read the declarations carefully. Sign and print your name, then provide the date of signing. If you are signing on behalf of another person, state your capacity.

- Once all sections are completed, you may save your changes, download, print, or share the form as needed.

Complete the Hsbc Crs Individual Self-Certification Form online to ensure your tax residency information is accurate.

Related links form

Tax Identification Number/National Insurance Number (or equivalent where applicable) Account details (of the bank account or similar) The total account balance/value of your accounts calculated at the end of the calendar year, including any interest (excluding the balance of any excluded accounts)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.