Loading

Get Mi Dot 518 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 518 online

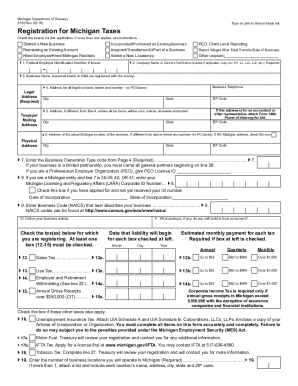

Filling out the MI DoT 518 online can streamline your business registration process in Michigan. The following guide provides comprehensive, step-by-step instructions to help you complete this essential form accurately and efficiently.

Follow the steps to complete the MI DoT 518 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by selecting the reason for your application. You can check multiple boxes if applicable, such as starting a new business or reinstating an existing account.

- In Line 1, enter your Federal Employer Identification Number (FEIN). If you do not have one, contact the IRS to obtain it.

- For Line 2, provide your Company Name. If applicable, include designators such as Corp, LLC, or LLP. If you are a sole proprietor, write your name here.

- Fill in your Legal Address in Line 4, where records are maintained. This address must be a physical location, not a P.O. Box.

- In Line 5, indicate the Mailing Address where you wish to receive tax forms. This can be a P.O. Box or a different address.

- Line 6 requires the Physical Address if your business location is different from the legal address. If you do not have a Michigan location, check the designated box.

- Complete Line 7 by entering the Business Ownership Type code based on your business entity structure. A list of codes is provided on the form.

- If applicable, provide your Michigan Licensing and Regulatory Affairs (LARA) Corporate ID Number in Line 8.

- In Line 9, enter the Business Code from the North American Industrial Classification System (NAICS) that matches your business activities.

- Describe the specific Business Activity in Line 10, detailing what your business will engage in.

- For Line 11, briefly outline the Products You Sell to the final consumer.

- From Lines 12 to 15, check all applicable tax types you plan to pay and indicate the start date for each tax liability.

- In Line 16, if you intend to pay Unemployment Insurance Tax, ensure your FEIN is recorded and complete the attached schedules.

- Continue completing the form, ensuring all required information is filled out accurately to avoid delays.

- Once finished, review all entries for accuracy. You can then save, download, print, or share the completed form as needed.

Start filling out the MI DoT 518 online today to effectively register your business in Michigan.

The Michigan Department of Treasury offers an Online New Business Registration process. This process is easy, fast, secure and convenient. This e-Registration process is much faster than registering by mail. After completing this online application, you will receive a confirmation number of your electronic submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.