Loading

Get Mi R0625c 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI R0625C online

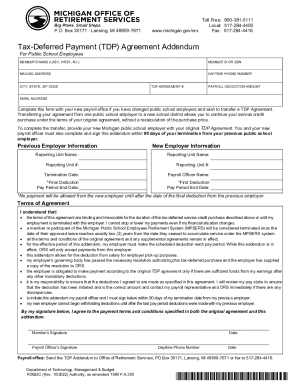

This guide provides a straightforward approach to completing the MI R0625C form online. Follow the instructions carefully to ensure that all necessary information is accurate and submitted properly.

Follow the steps to successfully fill out the MI R0625C form.

- Press the ‘Get Form’ button to access the MI R0625C form and open it in your preferred editor.

- Begin by entering the member's name in the format of last name, first name, and middle initial. This is essential for accurate identification.

- Provide the member ID or Social Security Number (SSN) in the designated field to associate the form with the correct individual.

- Fill in the mailing address, ensuring to include street address, city, state, and ZIP code for correspondence.

- Enter the daytime phone number to allow for contact regarding the form if necessary.

- Input the TDP Agreement number in the appropriate section to reference the original agreement.

- Specify the payroll deduction amount to be taken as part of the TDP Agreement to ensure clarity on the financial arrangement.

- Include the email address for any electronic correspondence related to this agreement.

- Fill out the previous employer information, including reporting unit name and number, and termination date.

- Complete the new employer information, ensuring you include their reporting unit name and number.

- Indicate the final deductive pay period end date from the previous employer and the first deductive pay period end date from the new employer.

- Review the terms of the agreement thoroughly to understand obligations before signing.

- Sign and date the form at the bottom of the document, both the member and payroll officer must do so.

- After completing all sections, save changes, and choose to download, print, or share the completed form as needed.

Complete your documents online today to ensure timely processing and compliance.

*A list of retirement plan deductions follow this summary; all retirement deductions are pre-tax but are subject to FICA taxes, including TDP (tax deferred payment for buying service credit) deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.