Get Form 2599 Michigan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2599 Michigan online

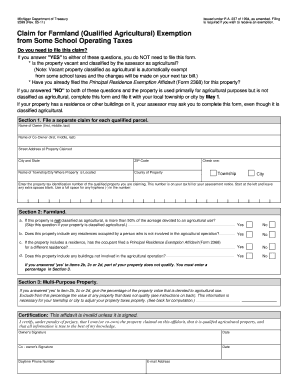

Filling out Form 2599 is essential for anyone claiming a farmland exemption from certain school operating taxes in Michigan. This comprehensive guide will provide you with step-by-step instructions to ensure you complete the form accurately and efficiently online.

Follow the steps to complete the Form 2599 Michigan online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, provide your name, including first, middle, and last names, as well as the name of any co-owner. Then, fill in the street address, city, state, and ZIP code of the property that you are claiming.

- Indicate the township or city where the property is located by checking the appropriate box for either County, Township, or City.

- Enter the property tax identification number associated with the qualified property, ensuring to start from the left and leave extra spaces blank, using a full space for any hyphens.

- Move to Section 2, where you will answer specific questions about the farmland. If the property is not classified as agricultural, you must confirm whether more than 50% of the acreage is used for agricultural activities.

- Continue answering the questions regarding any residences on the property and whether they are occupied by individuals not involved in the agricultural operation.

- If necessary, complete Section 3 by providing the percentage of the property value dedicated to agricultural use, particularly if you answered ‘yes’ to any questions in Section 2.

- Sign and date the form in the certification section, confirming that the information provided is accurate. Ensure that the co-owner also signs if applicable.

- Lastly, you can save any changes made during the online completion, download, print, or share the filled-out form as needed.

Complete your Form 2599 Michigan online today to ensure your farmland exemption is processed.

Filing Michigan sales tax involves calculating the total sales tax collected and filling out the appropriate tax forms. You need to report this information through the Michigan Department of Treasury's system, often requiring further documentation. While Form 2599 Michigan is not directly linked to sales tax, it highlights the importance of keeping your tax records organized. Using continuous online resources can help streamline this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.