Loading

Get Burs Sad 500

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BURS SAD 500 online

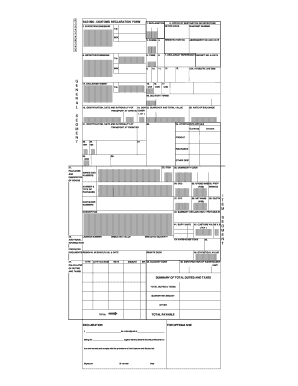

The BURS SAD 500 is a customs declaration form used in the export and import process. Completing this form accurately is essential for compliance with customs regulations. This guide provides clear, step-by-step instructions to assist users in filling out the BURS SAD 500 online.

Follow the steps to complete the BURS SAD 500 form online.

- Click the ‘Get Form’ button to obtain the BURS SAD 500 and open it in your preferred format for editing.

- Fill in the 'Office of destination or departure' section by entering the appropriate office code and manifest number.

- Provide the registration number and recipient details in the 'Exporter/Consignor' field.

- Complete the 'Items' section by listing all items that are being exported or imported. Make sure to enter the correct quantities and descriptions.

- Enter the declarant reference number as well as the receipt number and date in the designated fields.

- In the 'Importer/Consignee' section, include the TIN of the importer.

- Fill out the details such as identification, date, and nationality of the transport at arrival.

- Include the delivery terms and specify the currency and total value of the transaction.

- Complete the 'Rate of exchange' field and document any additional costs such as freight and insurance in the respective sections.

- Provide a detailed summary of goods, including gross mass, net mass, commodity codes, and any other relevant descriptions.

- Confirm the summary of total duties and taxes and ensure that the guarantee amount is accurately recorded.

- Acknowledge the declaration section by signing and dating the form to confirm the information provided is accurate.

- Once all fields are completed, save your changes, and choose to download, print, or share the completed BURS SAD 500 form as needed.

Complete your BURS SAD 500 online to streamline your customs declaration process.

The SAD 500 is a customs document specifically designed for use in Botswana, playing a critical role in international trade. It simplifies the customs declaration process by standardizing the information required for compliance. Utilizing the BURS SAD 500 helps businesses navigate customs regulations effectively, ensuring that imports and exports are handled smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.