Loading

Get Canada T776 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T776 online

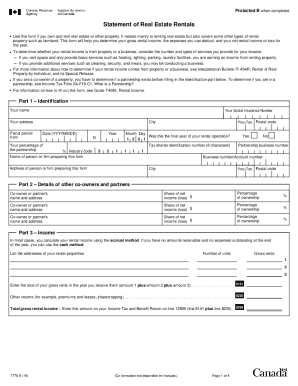

The Canada T776 form, Statement of Real Estate Rentals, is essential for individuals who own and rent out real estate or other properties. This guide will provide clear guidance on how to efficiently complete this form online, ensuring you correctly report your rental income and expenses.

Follow the steps to fill out the Canada T776 form online.

- Press the ‘Get Form’ button to acquire the Canada T776 form and open it in your preferred document editor.

- In the Identification section, fill in your personal information, including your name, Social Insurance Number, address, fiscal period dates, industry code, and any partnership business number if applicable.

- Proceed to Part 2 and provide details of any co-owners or partners, including their names, addresses, share of net income or loss, and percentage ownership.

- Move on to Part 3, where you will need to list your rental properties' addresses, number of units, gross rents received, and any other income. Calculate your total gross rental income.

- In Part 4, record all relevant expenses related to your rental operations. Include categories such as advertising, insurance, interest, repairs, and any other deductions you are eligible for.

- Review the calculations for net income or loss based on total gross income and deductible expenses. Ensure all entries are accurate before moving to the final steps.

- After completing all sections, save your changes. You may then download, print, or share the completed Canada T776 form as needed.

Complete your Canada T776 form online today to ensure accurate reporting of your rental income and expenses.

all rental income from property is reported on a calendar year basis. personal income tax return filing due date is April 30th. To input rental income in the Canadian Tax and RRSP Savings Calculator, include rental income from business as self-employment income, and rental income from property as "other income".

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.