Loading

Get Form 8453 Ol

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8453 Ol online

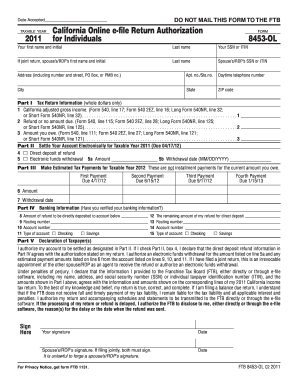

Filling out Form 8453 Ol, the California Online e-file Return Authorization for Individuals, is an essential step in completing your tax return. This guide will provide you with clear, step-by-step instructions to ensure the form is filled out accurately and efficiently.

Follow the steps to complete Form 8453 Ol online.

- Click 'Get Form' button to access the Form 8453 Ol and open it in your preferred online editor.

- Enter your first name and initial, followed by your last name, and your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you are filing jointly, fill in the same details for your spouse or registered domestic partner (RDP).

- Provide your complete address, including street number and name, apartment number (if applicable), city, state, and ZIP code. Include your daytime telephone number for contact purposes.

- In Part I, report your California adjusted gross income. Use the line corresponding to your tax form (Form 540, Form 540 2EZ, Long Form 540NR, or Short Form 540NR) to find the correct figure.

- Indicate whether you expect a refund or if you owe money to the state. Reference the appropriate line from your tax form to accurately report this information in Part I.

- If applicable, complete Part II by selecting your preference for direct deposit of your refund or electronic funds withdrawal. Indicate the amount you wish to withdraw and the withdrawal date.

- In Part III, specify your estimated tax payments for the following year. List the payment amounts and due dates as needed.

- Enter your banking information in Part IV. This includes your account number, routing number, and indicate whether it is a checking or savings account.

- Review the information you have entered carefully to ensure accuracy, especially your banking details to avoid any issues with electronic transactions.

- In Part V, sign the form to authorize the information provided. If filing jointly, ensure your spouse or RDP also signs. This step is necessary before submitting the form.

- Once all sections are complete and verified, you can save the changes, download, print, or share the form to remain compliant with your filing requirements.

Take control of your tax filing process and start filling out your Form 8453 Ol online today!

If the taxpayer is signing the electronically filed return by using a PIN, use Form 8879, California e-file Signature Authorization for Individuals. ... If the taxpayer is signing the return via handwritten signature, use Form 8453, California e-file Return Authorization for Individuals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.