Loading

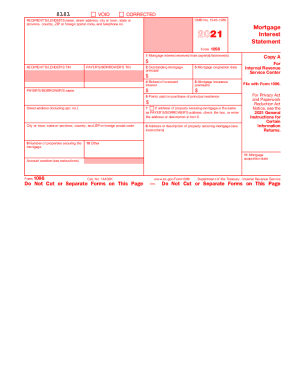

Get 2021 Form 1098. Mortgage Interest Statement

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2021 Form 1098. Mortgage Interest Statement online

The 2021 Form 1098, Mortgage Interest Statement, is an essential document for reporting mortgage interest that you paid within the tax year. This guide provides clear, step-by-step instructions for filling out this form online, ensuring you understand each field and its importance.

Follow the steps to complete the form accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify and fill in the recipient’s/lender’s information, including their name, street address, city, state, ZIP code, and telephone number. This information will typically be pre-filled or easily accessible.

- Enter the mortgage interest received from the payer(s)/borrower(s) in Box 1. Ensure this figure includes only the interest, not any points or overpaid interest.

- Input the outstanding mortgage principal in Box 2 as of January 1, 2021. If the mortgage originated during 2021, use the principal at the origination date.

- Fill out the mortgage origination date in Box 3. This is the date when the mortgage loan agreement was established.

- Include any refund of overpaid interest in Box 4, specifically addressing prior year overpayments.

- Complete Box 5 if there are mortgage insurance premiums to report.

- Report points paid on the purchase of the principal residence in Box 6. Be sure to determine whether these points are deductible for the current tax year.

- If the address of the property securing the mortgage is the same as the payer’s/borrower’s address, check the box in Box 7. If not, enter the correct address in Box 8.

- For Box 8, provide the address or description of the property that secures the mortgage.

- Indicate the number of properties securing the mortgage in Box 9. If only one property is securing the loan, this box can remain empty.

- Utilize Box 10 to report any additional information the recipient may need to communicate to the borrower, such as real estate taxes.

- If the mortgage was acquired in 2021, enter the acquisition date in Box 11.

- Once all fields are filled out, save your changes, and consider downloading, printing, or sharing the form as necessary.

Start the process now to complete your mortgage interest statement online efficiently.

No, you don't have to actually file Form 1098 that is, submit it with your tax return. You only have to indicate the amount of interest reported by the form. And you generally only report this interest if you are itemizing deductions on your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.