Loading

Get Standard On Valuation Of Personal Property - Iaao

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Standard On Valuation Of Personal Property - IAAO online

This guide provides comprehensive instructions on filling out the Standard On Valuation Of Personal Property - IAAO form online. Users will find clear and step-by-step guidance tailored to their needs.

Follow the steps to complete the form efficiently.

- Click the ‘Get Form’ button to access the form and open it in your preferred online document editor.

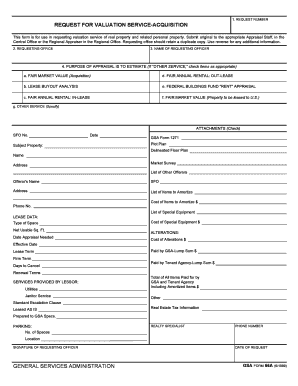

- In the first section, enter the request number for the valuation service acquisition. This helps in tracking your request and must be completed accurately.

- Next, indicate the requesting office by filling in the designated field. This identifies where the request is coming from.

- Enter the name of the requesting officer in the appropriate space. This is important for accountability and follow-up on the request.

- Specify the purpose of the appraisal. Check the box for the type of valuation needed, such as fair market value or lease buyout analysis, and provide any additional necessary specifics.

- Move on to the attachments section and check the boxes for any supporting documents you are submitting with the request. This ensures that all necessary information is considered.

- Detail the subject property's information including the name and address. Accurate property details are crucial for proper valuation.

- Provide the lease data, such as type of space, total usable square footage, and dates pertaining to the appraisal and lease. Complete this section thoroughly, as it influences valuation.

- In the services provided by the lessor section, list any amenities included in the lease. This could affect the overall appraisal outcome.

- Itemize any costs related to items to amortize and alterations. This includes costs paid by GSA and tenant agency, making sure to provide clear figures.

- Include real estate tax information where applicable. Accurate tax records can be beneficial for the valuation process.

- Finally, fill in the parking details if relevant. Include the number of spaces and all required information.

- Once all sections of the form are completed, save your changes, and download the form in your desired format. You can print or share it as needed.

Complete your valuation request online with confidence today!

6.3 Maintaining Property Characteristics Data Periodic physical review (IAAO 2013b, p. 8 recommends every four to six years) is essential to maintain an accurate and current inventory. Building permits do not catch all changes in property characteristics, especially those related to property condition.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.