Loading

Get Simple Promissory Note - Legalformsorg

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SIMPLE PROMISSORY NOTE - LegalFormsorg online

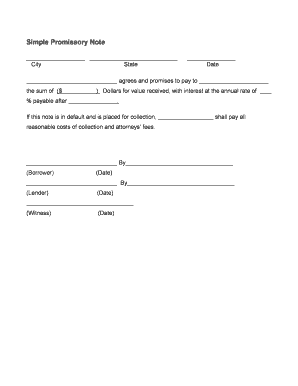

A simple promissory note is a crucial document that outlines the terms of a loan agreement between a borrower and a lender. This guide will help you navigate the process of filling out the SIMPLE PROMISSORY NOTE - LegalFormsorg online, ensuring all necessary information is accurately captured.

Follow the steps to complete your simple promissory note online.

- Click 'Get Form' button to obtain the form and access it in the online editor.

- Enter the city and state where the promissory note is being executed.

- Provide the date on which the note is being signed.

- In the first blank field, state the name of the borrower who agrees to repay the loan.

- In the second blank, specify the amount being borrowed in dollars.

- Indicate the annual interest rate that will apply to the loan in percentage.

- Specify the payment terms by indicating when the interest and principal are payable.

- Identify the party responsible for collection costs in case of default by stating their name.

- Each party—borrower and lender—should sign and date the document to validate the agreement.

- A witness should also sign and date the document to provide additional verification.

- After reviewing all entries for accuracy, save your changes, and choose to download, print, or share your completed form.

Start now and complete your simple promissory note online for efficient document management.

Promissory notes are legally binding contracts that can hold up in court if the terms of borrowing and repayment are signed and follow applicable laws. Important details to include are: The amount of money borrowed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.