Loading

Get Ct Probate Form Pc 256

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct Probate Form Pc 256 online

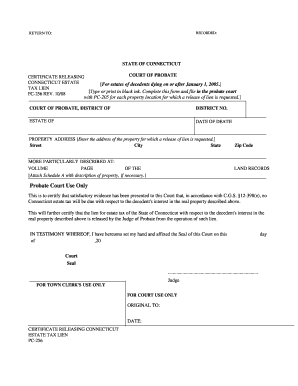

Filling out the Ct Probate Form Pc 256 online provides a streamlined way to request a release of estate tax liens in Connecticut. This guide offers step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form online

- Click ‘Get Form’ button to access the document and open it in your preferred online editor.

- Begin by entering the District of Probate. You will find a designated field where you can input the specific district number relevant to your case.

- Next, provide the name of the estate for which the lien release is being requested. This typically includes the full name of the decedent.

- Fill in the date of death of the decedent. Ensure that you use the correct date format to avoid any discrepancies.

- In the property address section, enter the complete address for the property related to the estate tax lien. This includes the street address, city, state, and zip code.

- If necessary, attach Schedule A with a more detailed description of the property. This document should provide additional information to support your request.

- Once all fields are accurately filled, review the entire form for any errors or omissions. This helps ensure a smooth filing process.

- Finally, save your changes, and download or print the completed form. You can also share it if necessary before submission.

Complete your Ct Probate Form Pc 256 online today for a hassle-free experience.

If no will exists, the property is divided according to Connecticut law. The Probate Courts ensure that any debt owed by the deceased person, funeral expenses and taxes are paid before the remaining assets are distributed. Often a family member or friend is responsible for settling the affairs of the estate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.