Loading

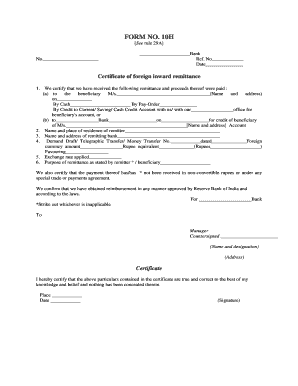

Get 10h See Rule 29a No

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 10H See Rule 29A No online

The 10H See Rule 29A No form is essential for certifying foreign inward remittances. This guide provides clear and user-friendly instructions for completing the form online, ensuring a smooth process for users.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- In the designated space for 'No.', enter the specific number assigned to the form. This ensures proper identification of your document.

- Fill out the bank name in the provided area, which indicates the institution associated with the remittance.

- Add the reference number in the specified field to relate this certificate to the specific transaction.

- Record the date when the form is being filled out to accurately document the transaction timeline.

- In section one, provide details about the remittance received for the beneficiary. Include their complete name and address.

- Indicate the method of payment by checking the relevant box for Cash, Pay-Order, or Credit account, providing details as necessary.

- For another beneficiary, if applicable, repeat the process with the relevant details in section one, part (b).

- Next, fill in the remitter's name and place of residence for identification purposes.

- Input the name and address of the remitting bank to ensure all parties are correctly acknowledged in the transaction.

- Complete the section on Demand Draft, Telegraphic Transfer, or Money Transfer details, including number, date, foreign currency amount, and the rupee equivalent.

- Specify the exchange rate that was applied in the transaction.

- Clearly state the purpose of the remittance as described by the remitter or beneficiary to maintain transparency.

- Confirm if the payment was received in non-convertible rupees or under any special agreements. Strike out as applicable.

- Finalize the form by providing the signature of the authorized signatory along with their name, designation, and bank details.

- Save your changes, then download, print, or share the completed form as required.

Complete your 10H See Rule 29A No form online today for a seamless remittance process.

Physical FIRC was discontinued by the end of 2016. Currently, Issuers can only apply for an e-FIRC. The answer is; Banks can issue an e-FIRC, but not all banks. ing to the RBI guidelines, an e-FIRC can be issued only by AD Category-I banks authorised and monitored by RBI for such remittances under the law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.